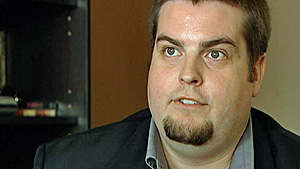

Yannick

Cloutier says Revenue Canada stripped him of child bene fits after he moved in

with his common-law spouse.

(CBC)

Yannick

Cloutier says Revenue Canada stripped him of child bene fits after he moved in

with his common-law spouse.

(CBC) An Ottawa-area father who raised two children on his own for

eight years claims the Canada Revenue Agency stripped him of child tax benefits

after he moved in with a common-law spouse.

Yannick

Cloutier says Revenue Canada stripped him of child bene fits after he moved in

with his common-law spouse.

(CBC)

Yannick

Cloutier says Revenue Canada stripped him of child bene fits after he moved in

with his common-law spouse.

(CBC)

Yannick Cloutier said he received a letter from the federal

agency recently advising him that the benefits would be transferred to his

common-law spouse — two years after she moved in with him.

The agency ruled that under the so-called "female presumption

rule", the benefits must now go to his girlfriend, despite the fact she has no

biological connection to Clouthier's son and daughter, and did not raise them.

His partner, Chantal Huot, was given 30 days to reply to the

letter. If she failed to reply within the time limit, the benefits would be

cancelled.

Cloutier said the rule is based on sexist assumptions about

the family that have no connection to m odern reality.

"I don't know why the government would think today now

there's a woman that my rights are gone," he said. "I told them I didn't realize

I called the 1950s."

Huot said she filed the necessary paperwork in time.

But both Cloutier and Huot said the rules must change to take

present-day situations into account.

"I think it's wrong. I think the parent should be getting it

whether you're a woman or a man," Huot said.

"Not everybody's like me…Anybody could just go for it and say

'yeah I want the money'. It's not right. Nobody should get this letter."

Revenue Canada declined to be interviewed. However, it did

say that this gender rule has gone before the courts and the Canadian Human

Rights Commission in the pa st, and the policy upheld.